TIAA CEO Roger Ferguson: How to close the $1 trillion racial wealth gap

As the 2020 Democratic candidates make the country’s growing wealth gap – which is the worst it’s been in half a century – a centerpiece of their campaigns, Roger Ferguson is uniquely positioned to weigh in on the issue.

Ferguson manages $1.3 trillion worth of assets as the CEO of TIAA, which provides investment and retirement plan services, and is one of just four African-Americans at the helm of a Fortune 500 company.

The wealth gap in the U.S. has grown significantly from 1989 to 2016. The richest 10% of families with at least $1.2 million in net worth own 77% of the wealth in the U.S. By contrast, families at the bottom half earning $97,000 or less own just 1%, according to the Federal Reserve Bank of St. Louis.

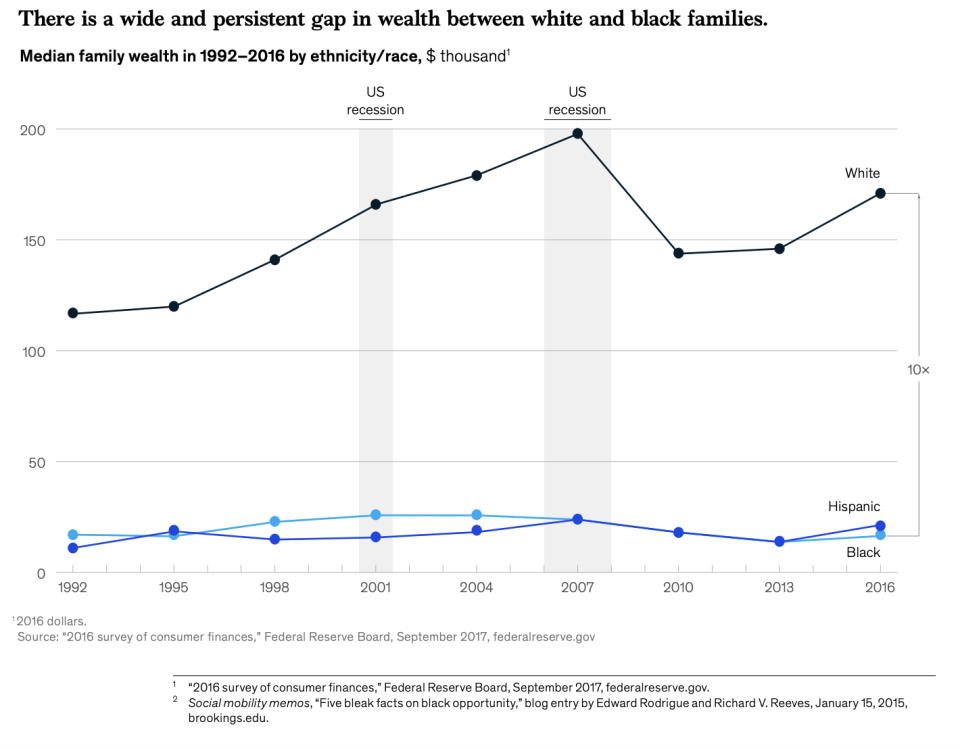

At the same time, the racial wealth gap between black and white families grew from about $100,000 in 1992 to $154,000 in 2016, according to a McKinsey report.

And McKinsey projects that failing to close the racial wealth gap will cost the U.S. $1 trillion to $1.5 trillion over the next decade because of its “dampening effect on consumption and investment.”

Ferguson offered a three-step approach to closing the racial wealth gap in an interview on Yahoo Finance’s The Ticker.

There’s no closing the wealth gap without first addressing income inequality, Ferguson said. And a big factor in income disparities is education.

“You’ve got to get to the place where African-Americans and minorities are not just getting into schools of higher education, colleges, and universities but that they are completing. And this has been one of the major challenges,” he said. “We find that in America overall, 60% to 70% of folks complete college. [For] African-Americans, it’s only about 30% to 40%.”

The second leg of Ferguson’s approach is investing. “We have to help African-Americans learn to diversify their asset pools,” he said. “African-Americans tend to be much more focused in housing, tend to be less focused in things that drive greater wealth such as equities.”

Improved financial literacy is the third part of Ferguson’s solution. TIAA just released the Personal Finance index, a measure of the current state of financial literacy and financial wellness among African-American adults. “We find that white Americans answer about 55%-60% of the questions correctly; African-Americans only about 38%,” said Ferguson.

“So there are folks who are not finishing college. They’re not getting into managerial jobs,” Ferguson said. “We have folks who are not diversifying across all the asset classes, and we have folks who have a low degree of financial literacy. If we can tackle those three things, we can start, over time, to close this wealth gap.”

Diversity at the top

Strong leadership is key to solving challenges facing the country, but diversity at the upper echelons of corporate America is hard to come by. He says the dwindling in the number of his CEO counterparts can be boiled down to demographics.

“About five or six years ago we had two or three times as many black CEOs as we have today. But many of my colleagues have retired. We can’t stop people from retiring,” Ferguson said.

Aside from that reason, Ferguson points out that infrastructure needs to be built within corporate America to have a clear pathway for African-Americans, minorities, and women seeking to ascend to the C-suite.

“A more structural reason is we’re finding that African-American professionals seem to top out at the upper-middle ranks of management. And we have to figure out ways to get them into higher levels of management consistently because C-suite executives, the CEO, the CFO, those are the ones we really have to focus on in terms of bringing black folks into those ranks,” he said.

Encouraging education for careers in fields that are growing will make a difference, Ferguson said. “Those tend to be more technical, the finance profession [for instance],” he said.

More from Sibile:

Why lower rates haven’t made buying a new home more affordable

Most Americans don’t expect better finances to result from Trump’s economy: survey

Democratic debate: Democrats rip apart Trump’s reelection playbook

UBS: Oil prices may prompt consumers to ask for higher pay

How population growth will impact Republicans in the 2024 election